Are you looking for the safe defense stock to invest in? If yes, this post will look at the BEL share price target 2024, 2025, 2026, 2027, 2028, 2029, and 2030 & 2040.

Along with the Bharat Electronics share price target, we’ll take a look at the company’s profile, Sector PE, ROCE, CMP, ROE, their peer &competitors, technical charts, fundamental analysis, strength & weakness, market cap, balance sheet, shareholding patterns, and much more.

After reading this post, we must say that you might able to decide whether this electronics & defense stock should be there in your portfolio or not?

A Brief Overview of Bharat Electronics Limited (BEL) History

The Bharat Electronics Limited (traded as BEL) is an Indian Public Sector Enterprise in the field of Aerospace, Electronics, and Defense sector under the assistance of Government of India. The BEL was founded in 1954 under the administration of Ministry of defense of India.

A few years ago, the company Bharat Electronics also granted a Navaratna status. Their headquarter is located in Bangalore, Karnataka, India. On 2000, the BEL was listed through IPO in NSE and BSE.

However, the Bharat Electronics Limited (BEL) incorporated with an aim of manufacturing advanced electronics products, semiconductor chips, and aerospace applications.

This Navratna company specializes in Defense, Satellite Communications, Avionics, and Aerospace under the Ministry of Defense, GOI. In this detailed blog post, we will get an idea and explore the BEL share price target for 2024, 2025, 2026, 2030, and up to 2040.

For long term investment, investor might be positive over this company because India is launching several programs in defense sector under Make in India.

Recently, BEL is successfully manufactured advanced radar system that will strengthen their defense programs. Just because of various programs the future of defense sector is very bright and soon, we will come out to be the powerful country of the world.

For the analysis, we will use different market indicators, time frames, weakness, strength, and technical analysis to predicts the potential and forecast of Bharat Electronics share up to the year 2040.

| Company Type- | Large Cap Company |

| Expertise or Industry- | Electronics, Semiconductor, and Defense |

| Ticker Symbol- | NSE- BEL. BSE- 500049. BSE- SENSEX. Nifty 50 Constituent. |

| Traded As (Listed In)- | National Stock Exchange (NSE). Bombay Stock Exchange (BSE). |

| Founded In- | 1954 |

| Founders- | Government of India |

| Headquarters- | Bangalore, Karnataka, India |

| Key People- | Manoj Jain (Chairman & Managing Director) |

| Area Served- | India and other countries |

| Parent Holders- | Ministry of Defense, Govt. of India |

| Subsidiaries- | BEL Optronic Devices Limited. BEL-Thales Systems Limited. |

| Official Website- | bel-india.in |

Fundamental Analysis of Bharat Electronics Limited (BEL)

Currently, the BEL Share Price today- Rs 251.50.

With the help of their fundamental analysis, we will get to know how strong the company is and with technical analysis, we might predict the BEL share price target tomorrow.

For this, we need to look at several parameters such as PE ratio, Book Value, OPM, PAT, Debt to Equity ratio, ROE, ROCE, EPS, and so on. So, below is table of data that will give you an idea about the financial data analysis of Bharat Electronics shares in the Indian Stock Market.

| Market Cap- | ₹ 2,05,370 Cr. |

| Total No. of Shareholders- | 27.72L |

| Total No. of Shares- | 731 Crores |

| P/E Ratio- | 45.20 |

| P/B Ratio- | 12.60 |

| Face Value- | ₹ 1.00 |

| Book Value (TTM)- | ₹ 24.20 |

| EPS (TTM)- | Rs. 6.21 |

| Dividend Yield- | 0.78% |

| Beta- | 1.78 |

| Promoter Holding- | 51.14% |

| ROE- | 26.30% |

| ROCE- | 34.60% |

| Debt to Equity- | 0.00 |

BEL Share Price Targets

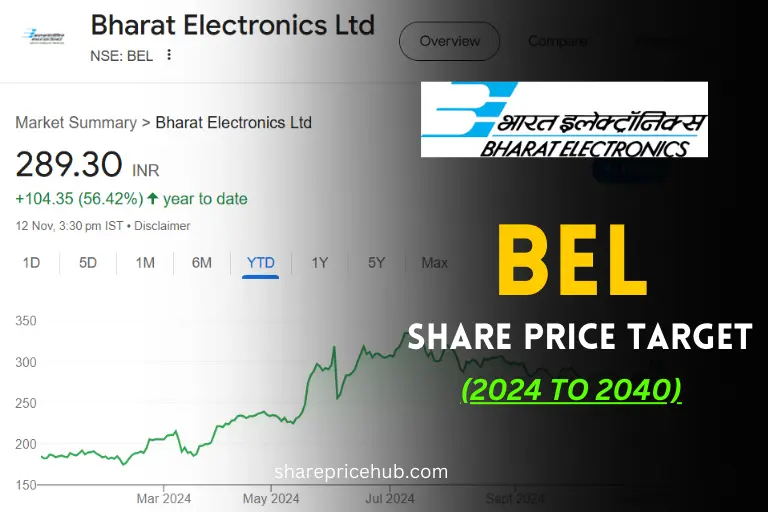

After analysing the growth, the Bharat Electronics company has a order book of Rs. 80,000 Crores in FY24 in which defence sector has maximum allocation. With this potential, BEL has tremendous potential in the upcoming years. In 2024, BEL has already broken their 52-week high of ₹340.

With this result, we may predict that the BEL share is going to perform amazing in the 10-15 years of investment considering increasing growth potential, positive order book, and growing Indian stock market. So, below we are providing the Bharat Electronics Share Price Target 2024, 2025 and up to 2030.

It may also be noted that the table below displays information of BEL Share Price Targets of all the particular years are just for education and learning purposes. Always take advice of your financial advisor before making any investments.

BEL Share Price Target 2024

| Year | Bharat Electronics Share Price in 2024 |

| 2024 | ₹136 to ₹345. |

Bharat Electronics Share Price Target 2024- Currently, market is in correction phase so we can predict that the BEL share will be in a range of Rs. 136 to Rs. 345 by the end of 2024.

BEL Share Price Target 2025

| Year | Bharat Electronics Share Price in 2025 |

| 2025 | ₹346.00 to ₹460.75. |

Bharat Electronics Share Price Target 2025– As the growing economy, India is investing a lot in defense sector so that India will be a self-dependent in defense in upcoming years. This will result a massive boom in the Defense stocks like BEL. With our prediction, the BEL Stock has chances to lie in the range of Rs. 346.00 to Rs.460.75 by the end of 2025.

BEL Share Price Target 2026

| Year | Bharat Electronics Share Price in 2026 |

| 2026 | ₹462.00 to ₹550.00. |

BEL Share Price Target 2027

| Year | Bharat Electronics Share Price in 2027 |

| 2027 | ₹551.00 to ₹655.50. |

BEL Share Price Target 2028

| Year | Bharat Electronics Share Price in 2028 |

| 2028 | ₹666.00 to ₹760.25. |

BEL Share Price Target 2029

| Year | Bharat Electronics Share Price in 2029 |

| 2029 | ₹762.00 to ₹830.10. |

BEL Share Price Target 2030

| Year | Bharat Electronics Share Price in 2030 |

| 2030 | ₹831.20 to ₹940.55. |

Bharat Electronics Share Price Target 2030– Considering positive stock market and increment in the order book of BEL company, the Bharat Electronics share looks positive and best in terms of returns (CAGR). For long term investment this defense stock has potential and their price will lie in the range of Rs.831.20 to Rs.940.55 by the end of 2030.

BEL Share Price Target 2035

| Year | Bharat Electronics Share Price in 2035 |

| 2035 | ₹942.50 to ₹1080.60. |

Bharat Electronics Share Price Target 2035– the BEL stock prediction for 2035 will lie between Rs.942.50 to Rs.1080.60 as the Indian government shake hands with Russia and USA to make the country self-dependent in defense equipment and related products for electronics, semiconductors, and defense program.

BEL Share Price Target 2040

| Year | Bharat Electronics Share Price in 2040 |

| 2040 | ₹1082.30 to ₹1240.90. |

Bharat Electronics Share Price Target 2040– Considering increase in EPS, PAT, Sales growth, book orders, profitable balance sheet, the BEL share will might lie between the price range of Rs.1082.30 to Rs.1240.90 by the end of 2040. One thing we can say that if you looking for the defense stock for the horizon of 10-15 years of investment then BEL share might prove to be the awesome pick for your portfolio.

Shareholding Pattern of Bharat Electronics Share

Below is the table that shows the overall shareholders including promotor holding, FIIs, DIIs, etc. in Bharat Electronics Limited share till September 2024.

| Total Promotor Holding | 51.14% |

| Mutual Funds | 15.81% |

| Other Domestic Institutions (DII) | 4.40% |

| Foreign Institutions (FII) | 17.27% |

| Retail Investors | 9.75% |

| Other Parties | 1.62% |

Strength and Weakness of BEL Share Price

This portion of the article showcase the strength and weakness of Bharat Electronics Limited in the Aerospace, Electronics, Defense sector so that people can decide whether the stock has potential or not.

| Strength | Weakness |

| Consistent high returns in NIFTY50. | Mutual Fund investors decreased. |

| Zero Debt. | MACD crossover below signal line. |

| Annual Profit Growth is increasing. | PE Ratio is high compared to Industry PE Ratio. |

| High EPS (TTM) growth. | |

| Increment in YoY and QoQ results. |

Bharat Electronics Limited Competitors

Below is the list of companies that shows an amazing competition as we compared their peers to Bharat Electronics share in the Electronics & Defense sector.

- Apollo Micro Systems.

- DCX Systems.

- Data Pattern Limited.

- HAL.

- GRSE.

- Paras Defense.

Final Words about Bharat Electronics Share Price Target

We hope that you found this educational post helpful about the BEL share price target. Bharat Electronics is good stock in Electronics & Defense sector because they manufacture semiconductors, radar systems, and other electronic equipment for satellite communications, defence, aerospace, and electronic sector.

With the above discussion, you can also decide whether you going to choose Bharat Electronics share for long term investment and swing trading.

One thing we must say, the demand for the defence equipments and semiconductor chips is going to increase in upcoming years as we move forward to become self-dependent nation. And this step will definitely help BEL share to grow and give tremendous returns to the investors in future.

Do your own research properly at your own risk because market is not predictable and news related to Defense and electronics sector or other scenarios could also impact the growth of Bharat Electronics stock price.

Therefore, these BEL stock price targets should use as a guideline and not as a financial advice. Always perform your owns research and knowledge before making any investments.

We hope that you all do proper research before picking the Bharat Electronics share for investment! Please read the Disclaimer below.